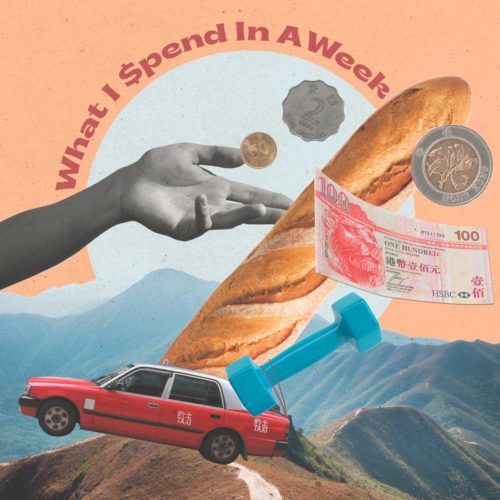

In this new series, we’re talking all things money. Join us as we take a look at the spending diaries of working women in Hong Kong, and discover their experiences and relationship with money, along with their exact salaries, how much they’re spending on rent and more…

In this inaugural edition, we’re spotlighting a Retail Marketing Director in her late thirties, who takes home a monthly salary of $70,000 to $80,000. All amounts are in Hong Kong Dollars.

The Basics

Job Title: Marketing Director

Industry: Retail

Age: 35–40

Take Home Pay: Between $70,000–$80,000 per month (includes base plus commission, which varies each month)

Monthly Expenses

Rent: $16,000

Utilities: On average about $500 per month

Others: Netflix – $63 per month, Hayu – $40, mobile contract about – $650, wifi – $298, part-time helper – $560, insurance policy – $2,500

Background

Growing up, what was your experience with money?

I grew up in a rather strict family and that strictness was multiplied x100 when we moved to Hong Kong. We weren’t used to all the “rich” expat families we met – we came from rural life, we lived amongst farmers in the countryside and although my dad had a very good job, we didn’t show for it – we lived humbly. Going to an international school was a culture shock on its own. The privilege! Friends who got dropped off in expensive cars by their drivers, chat amongst students about their extravagant holidays, seeing friends “bossing around” their helpers and the ridiculous amounts of pocket money they received.

I wasn’t allowed to ask for money – I used to only receive $40 per week as pocket money. I’m pretty sure I was the only student at 16 years old that worked a weekend job in a little café – gosh I remember being embarrassed when I had to serve students I knew from school. Every month I got paid by cheque. My parents had bought me a notebook which was to serve as my own little financial diary – everything I earned had to be marked down, and all my expenses were noted to the cent exactly. Each week they would go through my expenses, check the balance and challenge me on money spent on unnecessary items. “Why did you need that chocolate bar, you bring sandwiches for lunch” – yup, not going to lie, I very much disliked their way of teaching me about the value of a dollar.

You would think that would at least set me for life, that I would spend my money wisely and that I’d be set up for the future. Nope, it has had the opposite effect on me. I’m the least stingy person you’ll ever meet – I’m generous to a fault, but that is something I am working on! I am thinking about the future more seriously now.

Financial Goals

Do you have any short-term financial goals?

My younger years were a little irresponsible at times. I haven’t always lived within my means, so I am paying off some debts, which I want to be done with as soon as possible.

Do you have any long-term financial goals?

The future! Retirement! I now pay into a special insurance policy that is also a savings plan, and if I don’t touch that for another 16 years, I’ll receive a sum of about $2 million.

What does your savings plan look like?

Hmmm, I don’t exactly have a set plan per se, but I transfer part of my take-home pay to a different bank account in order to save. As stated earlier, $2,500 goes into a special fund for long-term savings. I also own a very small percentage of a recreational park in Europe, which gives me about $25,000–$35,000 every three months. Most of that goes into savings, but every now and then I take a bit of that and treat myself.

Career

What was you first proper job and starting salary?

I’ll be honest with you, I hated school – it wasn’t for me. University was a no, and I chose to work, grow, develop and build a career from the ground up instead. But at the fresh young age of 19, I still wasn’t too sure how to go about it all. I was told by many that teaching English was good easy money, so I thought sure why not?! Back then, it didn’t matter if you had a teaching degree or not, so I signed a contract with a small English learning centre, teaching English in a fun interactive environment to kids from the age of 2-12. I remember clearly showing my mum the contract, which stated a monthly salary of $11,000. To us back then for a first job, that was a good amount – and Hong Kong was much cheaper back then too, haha!

How close to the industry average do you think you’re being paid in your current job?

I know people who are in very similar roles for larger organisations that get paid a bit more, but it’s all relevant right?! I’m not unhappy, but of course, one always wants more. If I look at my career progression and therefore salary progression, it’s really not that bad. It’s Hong Kong’s political unrest and COVID that I blame for “salary freezes” and no increases.

Hong Kong Living

Aside from rent, what do you spend most of your money on in Hong Kong?

That’s easy – eating out, and exploring restaurants and bars. Let’s be honest, when you catch up with friends after work hours, it’s always dinner and/or drinks. The only “upside” of restrictions from 6pm is that I’m saving a tiny bit more.

What is worth spending money on in Hong Kong?

A spa treatment every now and then. Hong Kong has several excellent spas, and with many of us in high-pressured jobs and working long hours, I believe that you can’t put a price on wellness, health and relaxation. It’s not a monthly spend for me, but every quarter I’ll book myself a treatment or two.

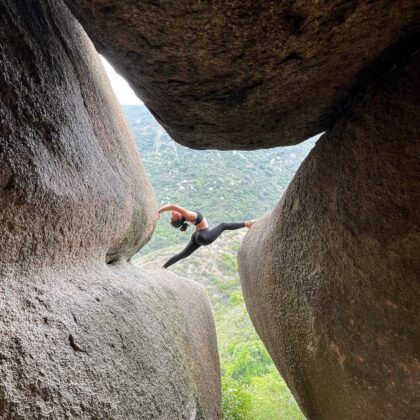

A personal trainer who keeps you motivated and basically kicks your butt. I admit, I get lazy, so I need someone to scream me into shape from time to time.

Uber rides to faraway places. I love exploring new parts of Hong Kong, but I dislike the travelling to and from.

A boat trip, but not the typical party junk. I’m talking about a relaxing quiet day (or overnight even) out at sea on a smaller boat with just a couple of your nearest and dearest. It is expensive, but with no travel, I feel it is justified once a year maybe. Go and see islands that junks don’t usually go to – those that are so far, you’ll have zero phone reception!

What is the best free/low-cost thing to do in Hong Kong?

Get into the mountains. Wasn’t it National Geographic that has called some of Hong Kong’s trails the best in the world?

Rent a kayak. It’s cheap and can be done from many different parts of Hong Kong. Explore, exercise, get a tan – what’s not to love?

City walks. If you’re looking to do something different with your significant other or a friend one weekend, pick a random neighbourhood from the MTR map and go explore! You’ll be amazed with what you’ll find.

Volunteer! As much as we complain about our own lives, jobs, salaries etc., let’s not forget that many in Hong Kong live below the poverty line. There are numerous charities that welcome volunteers in different forms. Hand out food, collect clothing, become a mentor, tutor, clean up a beach, support animal shelters – there’s so much we can do to help and it’s a great use of anyone’s time!

Spending Diary

Monday – $24.9

The start of the work week, definitely a case of the Monday blues, and then being reminded that your bus fare has increased, but your salary hasn’t been adjusted to match annual inflation. Yup, that got me grumpy a bit. On Mondays I don’t really spend – it’s a rather anti-social day for me. My bus fare into town is $16.2, and then it’s straight home from work on the bus again, now $8.7 as I’m travelling from another district. Yup, that is it today – a total of just $24.9.

Tuesday – $1,352.2

I’m slighter chirpier today because I’m taking the afternoon off. It’s the usual $16.2 bus fare into work, followed by a nice lunch with a good friend who’s leaving Hong Kong for a while. Now learning that lots of places do not offer set lunch with the 6pm restrictions in place, which is fair enough – restaurants need to pay their bills too and we don’t need any more of them closing down. Two courses and two glasses of wine each ended up being $696 per person.

Wanting to make the most of the afternoon off, I go see another friend for some drinks and spend another $300. Slightly tipsy, I impulsively buy a gift for someone as I walked by a shop and spend $220 on a birthday present. Home time – tipsy. That means I get a taxi, not bus, which is $120. That brings Tuesday to a total of $1,352.2. Yes, that’s on the higher end for a weekday, but let’s remember this doesn’t happen every day, and we still can’t go out for dinner…

Wednesday – $425.7

Hump day. It’s a good start because I get to sleep in a tiny bit more as my first work meeting is in a neighbourhood closer to home. That also means my bus fare is lower – $8.7. I buy a tea at this meeting, which is $35, and then take a taxi to the office – $71. Ok, that tea and taxi I get to put on expenses, but it still comes out of my own pocket first! I’m lucky I don’t have to spend on lunch if I don’t want to. The staff canteen/pantry is decent – gosh, I probably do save quite a bit on lunch knowing the amount I’ve spent in previous jobs.

I pick up a baguette and some cheese after work ($170) to bring to a friend’s dinner (lives at walking distance from my office). All of us were asked to bring something, not spending more than $200 each. After a rather interesting mix of different foods and drinks I taxi it home ($141). That’s a total of $425.7.

Thursday – $355.2

Waking up a little bit tired and thinking I have spent more than I normally would earlier in the week. I already can’t wait to be going home after work. It’s a $16.2 bus fare into the city. At lunchtime I walk to Watson’s for some necessities and spend $198. As the day goes by I tell myself I’m too tired and just want to get home, so I cheat and taxi it home for $141. Thursday comes to a total of $355.2.

Friday – $456.8

Wahoo, it’s a happy Friday indeed because I’m still clearing some annual leave, so I turn weekends into long weekends and have other friends who are doing the exact same. Today I’ll be spending some time at a friend’s place in Cheung Chau. I take the bus into Central for $10.3, pick up a nice bottle of wine from CitySuper ($380) and then get on the fast ferry for $28.1. There’s a bunch of us and because it’s a bit of a celebratory occasion, our hosts were so kind to treat us all to a wonderful seafood lunch. I spend another $28.1 on the ferry back to Central and then decide to take the bus home, not taxi – although that’s always so tempting. So another $10.3 and that ends my Friday on a total of $456.8.

Saturday – $1,030

No such thing as sleeping in. In terms of food and drink, this week has been a little indulgent so I did text my personal trainer on Tuesday to come today at 9am for an hour of torture in the outdoors. He charges me $640.

All tired and sweaty I make my way to the supermarket for my weekly shop. Mainly veggies, a bit of chicken, eggs, some bread, cheese and bottles of water – I spend $390.

Nothing social for me today, I’m enjoying quality time at home with lots of Neflix and a decent home-cooked meal. Saturday, you cost me $1,030.

Sunday – $150

I go for a two-hour hike with a neighbour, which costs me nothing except for time and effort. We have a quick, cheap lunch at $150 per person and I go home.

That’s all there is to my Sunday! I spent a total of $150. Mentally preparing myself for a long Monday at work ahead.

Total For The Week: $3,795.8

It’s been an eye-opening exercise as I come to a grand total of $3,795.8. It is more than I would have liked to spend (and I usually don’t spend so much in a week), so I think about where to save the following week.

I have got to take less taxies and just use my time on public transport wisely, so I don’t feel it’s a waste. I’ll be inviting friends over or spending time at theirs (when restrictions ease!) – less time out = saving more. I am even considering setting little monthly goals and saving targets per month or something along those lines. I’ll be thinking about this a bit more thoroughly in the next few weeks. Perhaps keeping some kind of financial journal may be the way forward after all…the irony!

Want to share your money diary? Get in touch at [email protected].

Artwork courtesy of Sassy Media Group, using images by ahei, Andrey_KZ, fatido, Grafner, jeffhochstrasser, kertlis, master1305, urfinguss, YinYang, zensu via Getty Images, Polina Tankilevitch via Pexels and Durmuş Kavcıoğlu via Unsplash.

Eat & Drink

Eat & Drink

Travel

Travel

Style

Style

Beauty

Beauty

Health & Wellness

Health & Wellness

Home & Decor

Home & Decor

Lifestyle

Lifestyle

Weddings

Weddings