Hassle-free house hunting

In a city as densely populated as our beloved 852, finding the flat of your dreams can be tricky in this competitive housing market. While most apartments in this city are (inevitably) on the cosier side, finding a space that meets your needs doesn’t have to be mission impossible. We’ve reached out to some professional brokers and have found a few tips and tricks to help you on your house hunting adventure to (hopefully!) make the process seem less complicated!

Read more: Best Homeware Stores in Hong Kong

What to watch out for:

Renting

If you’re looking to rent an apartment, it’s crucial to understand your tenancy agreement, says Connie Yuen, Senior Manager of Residential Services at Savills Hong Kong . Covering everything from deposits and management fees to break clauses (if you or your landlord need to sever your contract early before the lease has officially expired), you need to know exactly what is required of you as a tenant when you move into a new flat. The agreement also protects the tenant if any problems arise, and without a stamped agreement, it is impossible to take any future issues to court (if necessary); as a result, Yuen strongly urges tenants to be diligent, make notes on the terms and conditions of the agreement and not to just rely on the agent’s advice.

It is also important to factor in the cost of utilities (water, gas and electricity), which are usually not included in the property’s rent. This is usually outlined in the aforementioned tenancy agreement and a two- to three-month deposit is required prior to the handover day. Don’t forget to seek your agent’s advice when it comes to setting up these necessities before you officially move in, and make sure they’re under your name!

Read more: Where to Get Custom Furniture Made in Hong Kong

Purchasing

When buying a flat, Yuen says to make sure to factor in the additional costs that must be paid separately, such as stamp duty, agency fees and legal fees. Stamp duty usually varies depending on the price of the property, but it is possible to calculate it here. Expat buyers should bear in mind they are required to pay 30% stamp duty when they purchase a property, and it is also important to factor this into their overall housing budget. Make sure to discuss your mortgage with your bank before viewing properties so you get a better idea of what your options are.

How to bag a bargain

Whether you’re looking to rent or buy, it may be worth checking out an older building (also known as a ‘tong lau’). Apartments in vintage buildings tend to be bigger, more affordable and have flexible structures (should you plan to do some renovations once you move in!). However, be sure to find out if any external renovations have been recently done or are planned prior to deciding, in order to get a better idea of future expenses. These buildings also tend to not have elevators and other amenities, so if you’re after a flat with all of the trimmings, then it’d be best to steer clear!

On a more controversial note, while ‘haunted’ flats (i.e. apartments that were the site of a murder, death, etc.) are usually more affordable, it can be difficult to acquire a mortgage from the bank. Similarly, if a listing is located in a former industrial building, it is legally risky to consider moving in. Even if it has been renovated and listed as a residential property, there may be structural issues and most banks will not agree to provide financial assistance or insurance. to the best thing to do is research the property’s history– if a flat falls significantly below market price, it’s usually too good to be true!

Read more: Where to Buy Furniture and Homeware in Shenzhen

Areas that offer more for your money

Buying in areas gaining more buzz (think Kennedy Town and Sai Ying Pun over the last few years, now Tai Hang, Wong Chuk Hang, etc.) could reap even greater profits in the future. Thanks to MTR line expansions, areas that were previously regarded as inconvenient and difficult to commute to and from are now accessible! Property prices tend to increase rapidly once new MTR lines have been created; for instance, Wong Chuk Hang (formerly a very industrial area) is now trendy and brimming with galleries and cool restaurants. Now that the South Island Line conveniently stretches from South Horizons to Admiralty, commuting here has never been easier.

However, despite this, brokers advise potential buyers to still take a few months to view properties in hip, new areas before they decide. Because not all flats are created equal, and not every property is guaranteed to be a solid investment, it’s best to do some thorough investigating before you cash in! And if you’re an expat who is new to HK, be sure to live here at least one year before considering buying property.

Being realistic about your budget is key – don’t spend too much time trying to seek out a deal in an area with sky-high prices if it’s financially not viable for you. Even if you dream of living in a cosy little flat in uber-convenient and exciting areas such as Mid-Levels or SoHo, but you know you can’t afford these districts, the chances of finding a deal are slim. Instead, focus on areas where the median house price or rent fits comfortably within your budget, if not below it – you never know what gems you’ll find!

Vintage vs. New

Deciding whether you’d prefer to live in an older or newer building also comes with its own set of challenges! While older flats may seem more appealing due to their (generally) lower prices, it is even more crucial to thoroughly inspect the building in order to avoid any unwanted surprises.

While a fixer-upper is appealing, it’s best to know exactly what you’re in for. If you have your heart set on an apartment that needs a little TLC, depending on the condition of the property, it’s worth adding another 10 to 20 per cent (if not a little more!) onto your budget just to be safe. While it may seem glitzy and glamorous on the surface, a new building may also have its own share of hidden costs if not built well!

Read more: Our Go-To Handymen in Hong Kong

Common mistakes and things to remember…

Even though it’s all about location, location, location, it’s definitely worth considering what that phrase means beyond the obvious factors such as commute and price!

In addition to always keeping your budget in mind, know what other needs and preferences you need to address during your house-hunt. Do you have a dog, cat or other furry friend? The building needs to be pet friendly. Big family? How many people will the property accommodate. Make sure to incorporate your specific needs into the tenancy agreement and check that the landlord agrees to these terms.

It’s also seriously worth considering how important your work commute is to you, and what is best for your lifestyle. If proximity is high on your list of priorities, it would be wise to limit your search to areas that are near MTR stations. Alternatively, if you’re less bothered about a longer commute, and seek a bit of peace and quiet, living further away from convenient but noisy areas may be worth your while.

Brokers warn to inspect the property at least twice – after all, you’ll be living there every day, it’s definitely worthwhile to get a clearer idea of what to expect! Regardless of whether you do it yourself or hire a professional (Yuen recommends first-time buyers do the latter), it allows you to check out the ambiance of the surrounding area as well. If you’re purchasing property, once you have signed the sales and purchase agreement, it is crucial for your lawyer to acquire a record of the property’s past issues and repairs. Be sure to take photos of the property when you view it and on the day of the handover, especially if you notice any problems. Your ‘visual record’ will allow you sufficient evidence if any issues arise in the future.

Read more: Inside the Coolest Hong Kong Homes

Editor’s Note: This post was originally published on March 28, 2015 and was updated on February 5, 2018

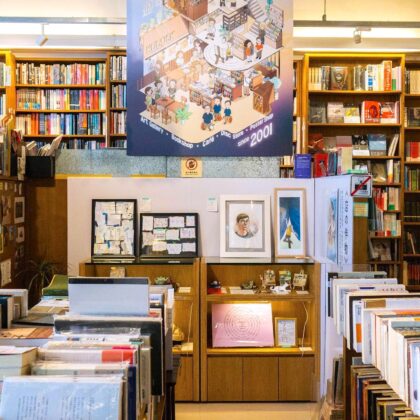

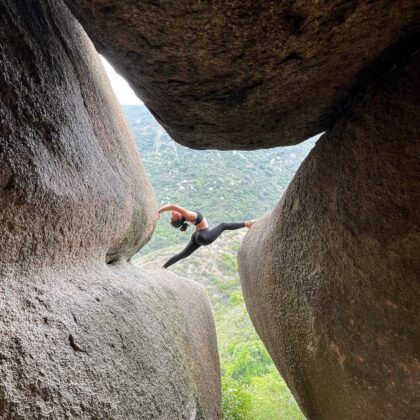

Featured image credited to Annie Spratt via Unsplash, image #1 credited to bizzayb, image #2 credited to Richard Lee via Unsplash, image #3 credited toPeter Berko via Unsplash

Eat & Drink

Eat & Drink

Travel

Travel

Style

Style

Beauty

Beauty

Health & Wellness

Health & Wellness

Home & Decor

Home & Decor

Lifestyle

Lifestyle

Weddings

Weddings