Because we could all benefit from some extra help when it comes to our finances!

For some, the idea of seeing a financial advisor might feel like a luxury that many of us don’t need or don’t feel we can afford. But getting advice about your money and how it can help you reach your long term goals is something we can all benefit from, no matter your current financial situation.

What to know

So what exactly is a financial advisor? It’s basically an expert who will work with you to help you understand your financial health, as well as helping you define your long and short-term financial goals and the obstacles you might face meeting them. If appropriate, they will also advise you on financial programmes and investments that can help you achieve your goals through good planning. Even if you aren’t in a position to begin investing (or don’t feel like you earn enough or are old enough to need to start thinking about your long term goals), a financial advisor can help you at any stage of life by providing an informed, external view on your monetary health.

Read more: MPF 101: How To Make The Scheme Work For You

What to expect

Curious? We were! So we decided to send one member of Team Sassy along to a financial advisor to see how she got on. Here’s how she found the experience.

“I sat down for a coffee with Eleanor Coleman, the Principal and founder of The Financial Empowerment Group (a representative of St. James’s Place Wealth Management), which specialises in providing financial advice to women and LGBTQ+ couples and individuals in Hong Kong. I was initially hesitant about whether I really needed to see a finance expert. My bank balance is less than impressive and I have no savings, but in the end it was my looming 30th birthday and the realisation that I’ve reached the slightly less exciting anniversary of ten years of renting in very expensive cities (looking at you Hong Kong…) that encouraged me to make the appointment.

Once I’d taken the plunge it was time to take a long hard look at my finances. Before we met I spent 30 minutes filling out this financial checklist (which in itself was a big step for me), as I’m guilty of thinking about the now and never really taking a proper look at how I’m doing financially. Armed with this information I headed in to my meeting with Eleanor feeling much more prepared to have a conversation about money than I had previosuly (perhaps, ever!).

We began the meeting by talking about why I was there, before running through my current money situation and the goals I’d noted down. Eleanor used this information to put together a document with details of my earnings, my current savings and my needs, which she then used to estimate how much I’d need to save for my tax. We then had a candid conversation about the goals I’d defined and the steps that I needed to take to get there – which was not only incredibly enlightening but also felt very liberating. Money has been such a personal and taboo topic throughout my life, so it felt very empowering to have an open discussion about my earnings and goals with someone who understood my needs and the obstacles I face reaching them.

We ended the session by running through my next steps and the things I could do in the short term to help me meet my goals. Eleanor also ran me through a planning pyramid which really helped to visualise the things I could do in the short term to improve my financial health; saving an “emergency fund” and looking into critical illness cover. Granted they’re not the sexiest topics, but I now know that they are both incredibly important.

Read more: How Can I Protect Myself And My Family If I Get Sick

Armed with a much clearer picture of how I’m really doing money-wise and with achievable actions for how to shore myself up, I left the meeting feeling so much less daunted than when I’d initially made the appointment. I never thought I’d be someone that needed to see a financial advisor but it has made me feel so much more in control of and empowered to manage my money in a smarter way in the future.”

Top tips

So, if you’re thinking of making your own appointment with a financial advisor, here are our five top tips to help you get the most out of the experience.

- Prepare – Take the time to think about your current finances and your goals before your first meeting with your advisor. Being ready for your discussion will mean you’ll leave the meeting with more tangible next steps than if you arrive unprepared.

- Be honest – As tempting as it is to neglect to mention an unpaid credit card or spiralling shopping habit, you will get much more from your meeting if you are 100% honest about your finances. What you disclose is completely confidential and chances are if you do confront the areas of your finances that you’ve been too scared to, you’ll come away from your meeting with practical steps about how to address them.

- Leave your preconceptions at the door – You may be scared that your financial advisor will be intimidating or won’t want to work with you unless you have a huge budget to invest. In reality, a good advisor will let you know if they are the right person to work with your needs. If they’re not, they’ll help you find someone who is.

- Don’t think “it’s not for me” – Think financial planning is just for people in debt, or with huge responsibilities, or that you’re just not adult enough yet to need to think about it? Everyone can learn something from a financial advisor and chances are you’ll be surprised by how much you get out of the meeting.

- Take action – Make sure you take the advice you receive on board and do take action. The sooner you start managing your money with the help of your financial advisor’s advice, the sooner you’ll start working towards your goals.

Read more: Why “A Man Is Not A Plan”: Ensuring Your Financial Freedom

Featured image courtesy of Getty Images, image 1 courtesy of Robert Bogdan via Pexels, image 2 courtesy of Clay Banks via Unsplash.

Eat & Drink

Eat & Drink

Travel

Travel

Style

Style

Beauty

Beauty

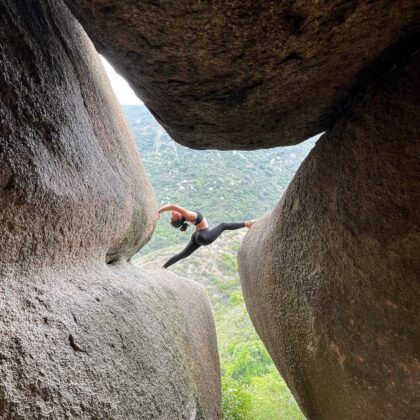

Health & Wellness

Health & Wellness

Home & Decor

Home & Decor

Lifestyle

Lifestyle

Weddings

Weddings