A bit coin-fused?

“Err, Bitcoin? I’ve heard of it, but not sure what it is.” Are they coins? Where are they? Why should I care? We’ve put together a beginners guide in an attempt to understand more…

How it started

In the 90’s, a group of privacy-conscious individuals called ‘cypherpunks’ started working on security models using cryptography. They started to use advanced mathematics to secure communications, commerce and finance. The innovation that arose from the development of cryptographic protocols, motivated by individual empowerment and distrust of the state, subsequently led to the creation of a cryptocurrency called bitcoin. Bitcoin is a cryptocurrency that lives in the internet. It was created by Satoshi Nakamoto in 2009, succinctly defining it as “a peer-to-peer electronic cash system.”

How it works

Bitcoin is backed by mathematical algorithms that enforce identity, enables transactions and creates value through a system called bitcoin mining. Let’s look at those concepts in detail…

Identity

Ownership of bitcoin is established by the possession of a private key, a large random number stored in your phone, computer, or even on a piece of paper. Since your private key allows you to spend your bitcoin, you must keep it securely in your control at all times, as opposed to keeping it at a trusted third party like a bank. A private key comes together with a public key, which can be safely handed to anybody. It is used for authenticating your identity and proving that you actually own the bitcoin. Therefore, owning bitcoin actually means owning a set of unique private keys in your possession. The saying “Not your keys, not your bitcoin” emphasises the importance of securing your private key in your control at all times.

Transactions

To send bitcoin, you must digitally sign a message with your private key and broadcast it to everyone running the bitcoin network. This is usually done automatically by an app. Similar to a bank cheque, the message representing the transaction contains the sender’s bitcoin address (identified by the public key), the receiver’s bitcoin address, the amount of bitcoin being sent, the transaction ID and the sender’s digital signature.

Instead of a central bank managing and verifying transactions, everyone gets to be their own bank by running the bitcoin software and maintaining a record of all transactions that happened in the bitcoin network. This record is called the blockchain. The blockchain is an append-only ledger that proves certain events happened in a specific order. In keeping a copy of the blockchain, everyone on the network is able to check and verify transactions themselves, and update their copies of the ledger if the transaction is valid. If the transaction isn’t valid, such as if the bitcoin has already been spent, the network rejects it. How do we keep participants honest? By incentivising them to play by the rules!

Bitcoin mining

The participants that propagate and verify bitcoin transactions are called nodes. Nodes are powerful computers that run the bitcoin software. Anybody can run a node and participate in the relay of information. Some nodes are “mining nodes” or “miners,” which group transactions in a “block” and record them on the blockchain. Miners use a lot of electricity in a race to solve a hard mathematical puzzle. The cost required to find the solution to the puzzle is called the “proof-of-work.” You can think of the proof-of-work as a competition to verify transactions. If your computer solves the math puzzle before the other computers, you get to verify transactions and receive 12.5 bitcoins, created from thin air, as reward. Proof-of-work prevents bad actors from spending the same bitcoin twice (double-spending) because it puts them in competition with everyone else trying to verify transactions, incentivizing the participants that control most of the computing power to be honest.

What makes it money?

Money started as a means of keeping track of debts. Early tribes used collectibles, like seashells, salt, beads, anything they can find in their environment to exchange with other individuals for a chunk of animal meat, firewood or other useful and desirable goods. What qualifies those resources to be used as a ledger? Scarcity! On economic principle, inherent scarcity increases a commodity’s value, which qualifies it as a possible store of value and medium of exchange. When tribes started to trade with other tribes, gold emerged as the first universal ledger. Why gold? Because it’s scarce. Additionally, it exhibits monetary qualities in that it is durable, portable, divisible, verifiable and fungible (units are interchangeable).

Comparatively, Bitcoin’s cryptographic algorithm only allows 21 million bitcoins to be mined, which gives it perfect scarcity. Due to the built-in incentive system, it’s also theoretically impossible to undermine the security and integrity of the ledger. Moreover, bitcoin can be easily carried and stored, divided down into a hundred millionth of a bitcoin called ‘satoshi’, which any two have, arguably, the same value, and which cryptographic signatures are prohibitively complex to break.

What are the challenges?

During peak shopping time, the Visa network is able to process 56,000 transactions per second. PayPal did an average of 241 transactions per second in 2017. Bitcoin could only handle roughly 3% of Paypal’s daily transactions, at seven transactions per second. Clearly, bitcoin needs to scale, and various exciting developments are in the works. One of them is the Lightning Network, a protocol that uses payment channels on top of the bitcoin network, allowing millions of transactions per second, lightning-fast. Another is RSK (Rootstack), a protocol which digitally enforces contracts on a blockchain pegged to the bitcoin network, allowing scalability of 100 near-instant transactions per second. Meanwhile, Ethereum is a distributed public blockchain network like Bitcoin, but focuses on running the programming code of decentralized applications using Ether, a crypto token that fuels the Ethereum network. Since Bitcoin’s success, other alternative cryptocurrencies called altcoins also emerged with different niches to fill.

What sets it apart?

Unlike government-issued currencies where value depends on national laws and trust in authority, bitcoin derives value from its technology and utility, the limited supply of 21 million and mutual agreement of its users. Equal nodes that voluntarily secure the network instead of a central entity make for its decentralised nature. This neutral architecture that renders the network borderless, makes identities or geography irrelevant, creating censorship-resistance.

Why Bitcoin?

Bitcoin empowers the individual. It’s an opt-in opt-out system that is backed entirely by code and the amount of users who voluntarily participate by using bitcoin either as a store of value or means of payment. Thousands of years of having to trust sovereign currencies and banks to manage and control our own money has made the value of controlling and securing our own assets far removed from everything we know and practice, but only with such extent of personal security and self-sovereignty can we truly attain freedom in an oppressive world under uncertain economic conditions.

Eat & Drink

Eat & Drink

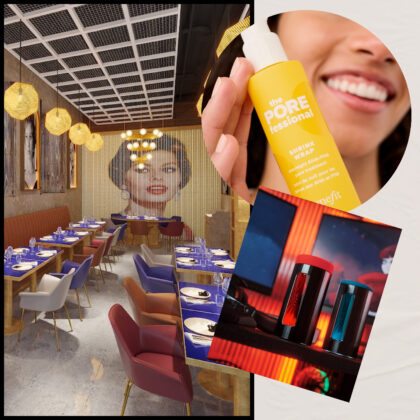

Travel

Travel

Style

Style

Beauty

Beauty

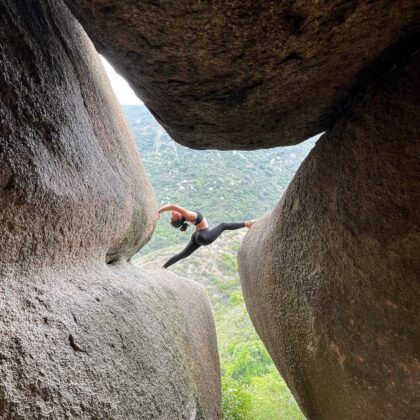

Health & Wellness

Health & Wellness

Home & Decor

Home & Decor

Lifestyle

Lifestyle

Weddings

Weddings