What you need to know about investing your money ethically…

It’s always a good time to examine our investments, priorities and to resolve to be better. This year more than ever, investors are looking to make a positive impact with their money and ethically invest in companies and projects that align with their values, as well as their hopes for profits.

Before making an investment, you may want to consider what we call “environmental, social and governance (ESG) criteria”. This is a set of standards that socially conscious investors can use to screen investments to make sure they are putting their money in the right place and are making a positive impact in the world.

Read more: The Beginner’s Guide To Investing

Ethical Investing: The ESG Criteria

Environmental

Investors use these criteria to evaluate the environmental impact, both positive and negative, that an organisation is making on the planet. This may include a company’s:

- use of energy

- pollution output, carbon footprint and emissions

- treatment of and testing on animals

- use of natural resources

- compliance with government environmental regulations

Social

Social criteria looks at the business relationships that the company has. This can include:

- how it interacts with its suppliers and partners

- how it treats its staff

- whether it donates time and resources to the local community

- whether it encourages its employees to do charity or voluntary work

- whether the people in management are committed to the health, safety, diversity and inclusion of their staff

Governance

Governance is a very hard metric to measure accurately. Essentially, it is the way that the company is run particularly in regards to:

- transparent and accurate accounting

- fair voting by stakeholders and shareholders

- conflict of interest with people in authority

The ESG criteria are designed to be a best case scenario and no single company may pass every test in each category. It is up to you as the investor to decide what is important to you.

When making an investment, limiting the choices to only “good companies” may feel like a trade-off, especially when traditionally “bad” company stocks have performed well. However, a company that takes risks on its environmental and social responsibilities may also be taking a risk on its performance. Consider BP’s 2010 oil spill and Volkswagen’s emissions scandal, both of which rocked the companies’ stock prices and resulted in billions of dollars in associated losses.

Is The Pandemic Be A Turning Point For Our Investment Decisions?

While the global pandemic has had a devastating social and economic impact, for our climate it’s a different story. Global daily carbon dioxide emissions dropped 17% in early April 2020, compared to the 2019 average. This proves that it is possible to reduce some of the impact carbon emissions have made on our planet.

A recent global survey found that 65% of respondents were in favour of a “green” economic recovery. This involves a sustainable approach to economic policy that centres on tackling climate change. Recovery policies, such as investing in renewable energy by subsidising and pushing down the cost of solar and wind power, are key for a more environmentally friendly economy.

The economic recovery from COVID-19 has the potential to have a bigger, more lasting and positive impact on our environment – perhaps even making moves to reverse some of the damage already caused by climate change.

The Role Of Investors

For those looking to make a personal positive impact on climate change, considering a more sustainable investment strategy can be a really great place to start.

Financial services company Nordea’s 2018 Sustainable Finance Report claims that greening your assets, such as your pension, investments and savings plans, could generate 27 times greater improvements in your personal carbon footprint than eating less meat, using public transport, reducing water use and flying less.

This is a critical time for investors to engage with companies that fulfil ESG criteria, and prioritise investment in those firms that are aligned to a sustainable economic model. The pandemic has opened our eyes to the possibility of achieving climate targets. As we decide what the “new normal” will look like, the economic recovery presents a prime opportunity to shape a world fit for future generations.

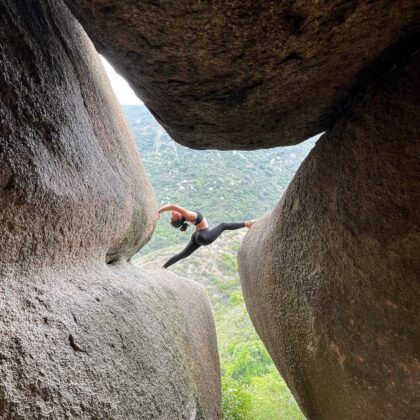

Featured image courtesy of Hannah Ka Yee Lee for Sassy Hong Kong, image 1 courtesy of Tim Samuel via Pexels, image 2 courtesy of FatCamera via Getty, image 3 courtesy of baona via Getty.

Eat & Drink

Eat & Drink

Travel

Travel

Style

Style

Beauty

Beauty

Health & Wellness

Health & Wellness

Home & Decor

Home & Decor

Lifestyle

Lifestyle

Weddings

Weddings