A life-changing tip from one shopaholic to another – regardless of how much you’re willing to spend, shopping can be a lot more rewarding than simply adding items to your wardrobe, decking yourself out in jewels, or feeling closer to The Peak by wearing that new pair of five-inch stilettos.

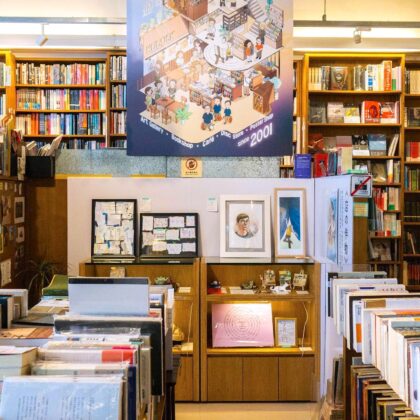

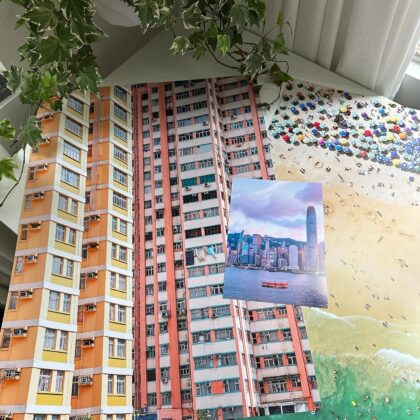

Let’s admit it. The shopping scene in Hong Kong makes every Sassy girl roam the streets and corners of the city like the fashion police, looking for a new haul. Our awe-inspiring shopping districts attract us like bees to a honey pot! We frequently hit up Causeway Bay, Kowloon, Tsim Sha Tsui and Central to find the latest fashion must-haves and to fall in love with our next fashion investment.

As great as shopping can feel at the time, we can all have a tendency to shell out the cash and swipe our credit cards a little too much, leaving us feeling not so great afterwards. That’s why making the most out of your purchases is important, as it can slightly ease that post-buy guilt! And how can you do that? By being smarter in using that credit card and rethinking exactly how you can get more when you set out to apply for one. If you’re ready to take the plunge and get a Hong Kong credit card, then making the right choice can certainly add a couple of bonuses to your future shopping experiences…

We took a look at the Top 5 Credit Cards for Sassy girls in HK. Here they are!

Image sourced via Pinterest

1. Manhattan Platinum Card/ MasterCard – for girls about town!

If you’re a That Girl who loves dining, shopping, travelling, and watching movies, then you’ll find the perfect company in the form of the Manhattan Platinum Card / MasterCard. It’s your perfect pass to getting year-round offers from a roster of brands, such as Agnes B. Delices, Hyatt Regency, Chow Sang Sang, IPSA, JSelect, Oisix, and Hong Kong Disneyland.

If you’ve long been dreaming of eye candies from Alexander Wang, Bulgari, Chloe, and Chanel, now is your chance to fulfil your dreams… And, did we forget to mention that you’ll finally get to walk in a pair of Louboutins? Discounts and offers on awesome brands such as these are available from Twist!

As a Manhattan Platinum cardholder, you can also get up to 5% cash rebate, free upgrade at Starbucks throughout the year (hello caffeine-fix!), and 50% rebate anytime at all cinemas in town.

2. Citibank I.T Visa Card – for the fashionistas!

If you’re a fan Citibank I.T VISA Card. If you’re a devoted follower of luxe brands, such as Alexander McQueen, Balenciaga, Celine, No.21 by Alessandro Dell’Acqua and Stella McCartney, among many others, then you shouldn’t think twice about getting the I.T!

You’ll receive exclusive offers from I.T. and its affiliate shops, year-round 10% discounts, and up to 20x points and 25% discount during your birthday month… talk about a celebration! The rewards programme will allow you to earn points that never expire, redeem items from the exquisite catalogue, and offset HKD 100 I.T spending instantly, with 25,000 points at I.T and its partner merchants.

To get you even more excited, you can RSVP to every pre-sale, fashion show, and pre-order I.T limited edition items!

Image sourced via Pinterest

3. Citibank Rewards Card – for shopaholics!

The shopping goddess in you will surely be delighted with Citibank Rewards Card, available in Visa, MasterCard, and UnionPay. The card is your ticket to earning 5x rewards points every time you shop in department stores and supermarkets, or pay your telecom bills – all year round! And what’s even better is that the points you earn never expire, so just keep shopping in places like Aldo, Armani Jeans, Charcoal Grey, Wrangler Jeans and more to get special discounts on your card! Keep collecting points, which you can redeem for rewards such as cash coupons, movie tickets, or air miles anytime… perfect.

4. HSBC Credit Card + Private Label Card – for luxury lovers!

What are you willing to do to have a private label card? You seriously don’t need to put yourself in a precarious situation because it’s easy as applying for an HSBC credit card!

If you qualify for an Advance Visa Platinum, Visa Platinum, Visa Gold, Dual Currency Diamond, or Dual Currency Credit Card at HSBC, you’ll get the chance to select a private label card. Your options are City/Super card, CODE card, Dickson card, and Le Saunda card. And wait — fans of British luxury fashion department stores, raise your perfectly manicured hands! Your HSBC credit card is your gate pass to having your very own Harvey Nichols private label card!

With your Harvey Nichols card, you can enjoy 10% off year-round discounts from participating brands at Harvey Nichols Landmark and Pacific Place Hong Kong, 30% off on dinner a la carte menu at Fourth Floor Restaurant & Bar, a special offer in your birthday month, and invitations to special sales promotion and exclusive events organised by Harvey Nichols Hong Kong.

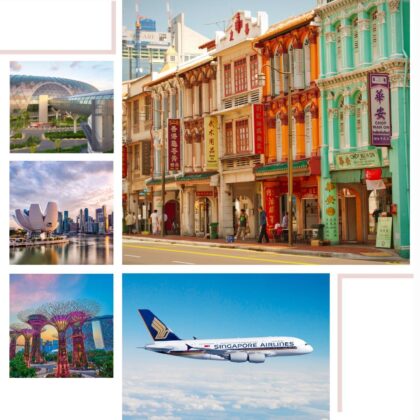

5. Standard Chartered WorldMiles Card – for travel lovers!

Standard Chartered WorldMiles Card is easily a must-have if you’re a Sassy girl who’s going places! For every $5 you spend on retail purchases in HK or abroad, you instantly get 1 air mile or 15 reward points. The more you shop, the quicker you collect air miles and the closer you get to your dream destinations (check out our top Asia bucket list destinations here)! You don’t have to worry about keeping track of annual fees either as this is waived on the card by Standard Chartered Bank.

Don’t have this card yet? Think about it no further, because if you apply for the WorldMiles Card online and get approved, you have the chance to get up to 35,000 miles (or 525,000 points) instantly! Spend a minimum of $5,000 in the first 2 months and these miles are all yours! See you at the beach…

Hopefully you’ll have more of an idea of what extra benefits you want to get out of your credit card, or you might have just realised that you do get extra benefits! For those who love to shop, it’s definitely worth considering what extra discounts and deals you may get depending on the bank you’re with. We’re all allowed to indulge in a bit of retail therapy every now and then!

Looking for more money tips? Check out www.moneyhero.com.hk for some credit card help, insurance comparisons and mortgage info.

Eat & Drink

Eat & Drink

Travel

Travel

Style

Style

Beauty

Beauty

Health & Wellness

Health & Wellness

Home & Decor

Home & Decor

Lifestyle

Lifestyle

Weddings

Weddings