Financial Musings of a Scotsman

You’re in Hong Kong to experience a new culture, travel to some amazing exotic destinations and soak up everything life has to offer. It’s also an excellent opportunity to build up a nest egg with those hard earned pennies. Read on for my top tips on how you can be financially savvy in Hong Kong.

Set out a budget

Hong Kong is the second most expensive place to live in the world (source: Economist Intelligence Unit survey). Needless to say, managing your money can be considered more important than ever.

Set out your income and outgoings on a monthly basis to get a clear picture of your finances. Fixed expenses like rental payments, utility bills, school fees and so on can all be accounted for to give you clear sight of what cash you have left over each month for daily living and all those exciting adventures you might have planned. You might get a surprise as to where all that money is going.

Tip: Check out neat.hk – It’s a pre-pay mastercard you can top up and use in Hong Kong and abroad. Did I mention it also does the budgeting work for you, tracks your spending habits and breaks it down for you each month? A great way to see where the pennies go and how to control your spending.

Pay yourself first

Many people pay bills, settle debts, live paycheck to paycheck, and are none the wiser on where there money disappears to.

Set up a cash account and move a portion of that money into a separate account each month. It doesn’t need to be much (I put aside 10% each month) but importantly it builds up over time, giving you a nice cash pot for the unexpected in life should you need some cash at short notice.

It’s all about peace of mind. You never know when you might need it. Aiming for 3-6 month’s worth of expenditure should keep you in the comfort zone.

Be tax ready

Your salary is paid ‘gross’ in Hong Kong which means no local tax is deducted immediately from your monthly salary. Instead the government claims any taxation due at the end of each tax year which runs from April 1 – 31st March.

Now the temptation would be to jump with glee at all this excess cash you immediately have in your hands. Tax is tomorrow’s problem, right?

In Hong Kong, the typical tax rates range from 2 – 17%, depending on your monthly income. With this in mind, consider putting aside a portion of your monthly income to build up a cash reserve to cover the eventual taxation bill.

‘Tax Loans’ are common in Hong Kong with relatively low interest rates, but why go into debt when you can cover this yourself with some simple forward planning.

Tip: Check out guidemehongkong.com for an estimation of your tax bill.

Join your employer pension scheme

Ask your employer if they have a Mandatory Provident Fund (MPF) or Occupational Retirement Scheme Ordinance scheme (ORSO) in place which you can join and contribute to. Your employer will usually contribute a certain percentage as well which allows you to build up additional funds for your future retirement.

If you leave Hong Kong at any point, the full fund can be drawn out and reinvested as you wish in your new country of residence.

Tip: If you are a UK expat, you may still be able to make pension contributions of up to £3,600 or your relevant UK earnings and receive tax relief at your rate of tax (max £3,600 per annum only up to 5 years post UK resident if no UK earnings).

Live within your means

Oh how dull you say. I’m here to have a good time not spend it counting my pennies.

One of the most common causes for people going into debt and poorly managing their finances is the limited use of one word – Knowing when to say ‘no’. Sure, I’d like to be out every weekend for dinner, off on holiday every other week and say yes to every social invite I get. The reality is you can’t always afford it all. Plan out your diary so you still max out the fun side whilst keeping your spending in check at the same time.

Be smart when choosing an adviser

There are thousands of Independent financial advisers, wealth managers and planners, investment managers (and so on) in Hong Kong. They also cater for a wide range of people, not just the wealthy few you may think.

If you are looking for financial advice be sure to be clear on the following:

- Are they qualified to give advice in Hong Kong?

- Are they licensed in Hong Kong?

- What is the company/persons reputation? Do your research.

Tip: Check out my ‘How to choose a Financial Adviser in Hong Kong’ article for further guidance here.

Save for your future with no tax

Hong Kong does not levy any taxation on investments. No capital gains tax, income tax or any nasty estate taxes on death. This gives you a great opportunity to invest a portion of your hard earned income into a suitable investments vehicle to generate potential capital growth and an income for you. A nice little pot for when something important comes along.

Be cautious here. There are no guarantees when investing your money and if it sounds too good to be true, it probably is.

Avoid high bank transfer fees when transferring money

If you regularly send money back to your home country, you may have found the fees chargeable for such transfers to be quite punchy. Check out moneytransfercomparison.com for the top international money transfer services available, many of whom charge no fees or commission for their services. A great way to avoid those hefty bank charges and make sure your money stays with you!

Enjoy it!

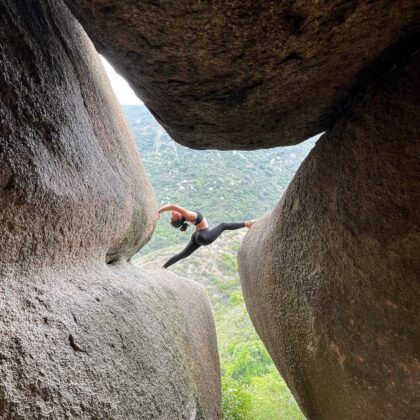

You are in Hong Kong, a city with a wealth of opportunities and experiences at your doorstep. Sure, I’ll guide you are how to live your life in a financially savvy way, but once those finances are in order you’ll find you open yourself up to even more exciting adventures. With the finances taken care of, you are ready to enjoy them guilt free!

Take Action

Even the smallest of changes can have a big impact on your financial well being. Take a consistent and disciplined approach with your finances to allow you to make the most of now, whilst planning for your financially secure future at the same time.

How financially savvy are you? Contact at [email protected] for a chat and more tips and tricks on how you can make the most of your money. Check out his other helpful ‘Financial Musings of a Scotsman’ articles here.

Eat & Drink

Eat & Drink

Travel

Travel

Style

Style

Beauty

Beauty

Health & Wellness

Health & Wellness

Home & Decor

Home & Decor

Lifestyle

Lifestyle

Weddings

Weddings